Inflation Report: Core Inflation Stays High at 3.9% – What It Means for You

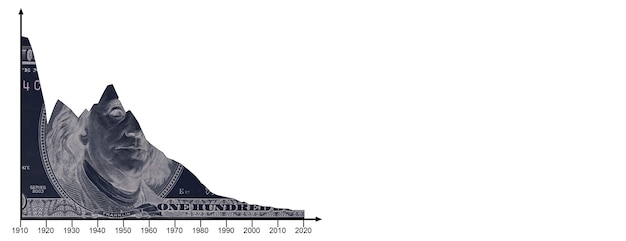

The latest Inflation Report reveals that core inflation remains stubbornly high at 3.9%, signaling persistent price pressures that could impact consumer spending, investment strategies, and the Federal Reserve’s monetary policy decisions.

The persistent challenge of inflation continues to be a key concern for economists and consumers alike, with the latest Inflation Report: Core Inflation Remains Stubbornly High at 3.9% capturing significant attention. This rate indicates underlying inflationary pressures that are proving difficult to mitigate.

Understanding the Core Inflation Rate

The core inflation rate is a critical metric used to assess the long-term trend of price increases within an economy. It excludes volatile components such as food and energy prices, offering a clearer picture of underlying inflationary pressures. Let’s delve into what this rate means in the current economic climate.

What is Core Inflation?

Core inflation focuses on the stability of prices in essential goods and services, excluding items with fluctuating costs. This helps policymakers and economists gauge the effectiveness of monetary policy and economic stability.

When we look at core inflation, we get a sense of where the real, persistent problems lie within the economy. It helps us see through the noise of temporary price spikes.

Why is Core Inflation Important?

Tracking core inflation provides valuable insights into the economy’s health. It indicates whether inflationary pressures are broad-based or isolated, aiding in the formation of effective monetary policies.

- Central banks use core inflation to set interest rates.

- Businesses utilize it to make pricing and investment decisions.

- Consumers can adjust their spending based on expected price changes.

In essence, core inflation acts as a barometer of the economy’s underlying stability. Monitoring this metric helps stakeholders at all levels.

Key Factors Driving the Persistent 3.9% Core Inflation

Several factors contribute to the persistent core inflation rate of 3.9%. Supply chain issues, increased demand, and labor market dynamics play a significant role. Let’s explore these elements to understand why inflation remains elevated.

Supply Chain Disruptions

Global supply chains faced significant disruptions due to the pandemic. These disturbances continue to impact the availability and cost of goods, contributing to inflationary pressures.

From raw materials to finished products, slowdowns in the supply chain ratchet up costs for businesses, which often pass those costs on to consumers.

Increased Demand

As economies recover, increased demand for goods and services puts upward pressure on prices. Consumers are spending more, but supply has not always kept pace, leading to higher inflation.

- Government stimulus measures increased consumer spending power.

- Pent-up demand from lockdowns led to a surge in purchases.

- Low interest rates encouraged borrowing and investment.

The mismatch between supply and demand is a significant driver of current inflationary trends. Addressing this imbalance is key to stabilizing prices.

Impact on Consumers and Businesses

Elevated core inflation has far-reaching implications for both consumers and businesses. Rising prices erode purchasing power and increase operational costs. Understanding these impacts is essential for navigating the current economic environment.

Effects on Consumer Spending

High inflation reduces the real value of wages, impacting consumer spending habits. Households may cut back on discretionary expenses and prioritize essential goods.

Every dollar buys less when inflation is high, leading consumers to make tougher choices about where to spend their money.

Effects on Business Operations

For businesses, rising input costs can squeeze profit margins. Companies need to adapt by increasing prices, improving efficiency, or absorbing some of the added costs.

- Businesses might hesitate to invest in new equipment or expansion.

- Increased labor costs can further strain profitability.

- Companies may need to renegotiate contracts with suppliers.

In response to these changes, businesses are exploring various strategies to mitigate the impact of rising costs.

The Federal Reserve’s Response

The Federal Reserve plays a crucial role in managing inflation through monetary policy. The Fed has tools at its disposal to moderate price increases, including adjusting interest rates and managing the money supply. Let’s examine how the Fed is responding to the current inflation challenge.

Interest Rate Hikes

One of the primary tools is raising interest rates. This increases borrowing costs, which can cool down economic activity and reduce inflationary pressures.

By increasing borrowing costs, the Fed aims to reduce demand and ease some of the inflationary pressure. This is a common strategy.

Quantitative Tightening

The Federal Reserve can also reduce the money supply through quantitative tightening. This involves selling assets and reducing the amount of money circulating in the economy.

- Reducing liquidity can lower demand.

- Shrinking the Fed’s balance sheet signals a commitment to fighting inflation.

- This can have a lagged effect, taking time to influence the economy.

These tools are intended to bring inflation back to the Fed’s target range. Balancing economic growth with price stability is a delicate task.

Expert Opinions and Economic Forecasts

Economists and financial analysts offer varying perspectives on the future trajectory of inflation. Some predict a gradual decline, while others foresee persistent challenges. Understanding these viewpoints can provide valuable insights.

Predictions of a Gradual Decline

Some experts believe that inflationary pressures will ease as supply chain issues resolve and demand normalizes. They anticipate a gradual decline in the core inflation rate over the coming months.

These experts often cite improvements in supply chain efficiencies and a moderation in consumer spending as reasons for their optimism.

Potential for Persistent Challenges

Other analysts caution that inflation may remain elevated for longer than anticipated. Factors such as wage pressures and geopolitical tensions could sustain inflationary forces.

- Tight labor markets could continue driving up wages.

- Geopolitical instability can disrupt supply chains.

- Monetary policy effects may take time to materialize.

These diverging forecasts highlight the uncertainty surrounding the future path of inflation.

Strategies for Navigating High Inflation

Consumers and businesses can take proactive steps to mitigate the impact of high inflation. Budgeting wisely, investing strategically, and adapting business models are all viable approaches. Let’s explore these strategies.

Budgeting and Financial Planning

Consumers can create a budget to track expenses and identify areas for savings. Prioritizing needs over wants can help manage financial strain during inflationary periods.

Careful financial planning and setting clear financial goals are more important than ever during times of inflation.

Investment Strategies

Investing in assets that tend to hold their value during inflation, such as real estate or commodities, can help protect purchasing power. Diversification is also critical.

- Consider inflation-indexed securities.

- Explore real estate as a hedge against rising prices.

- Diversify portfolios to manage risk.

Prudent investment strategies can help preserve wealth during inflationary times.

Business Adaptations

Businesses can adapt by improving operational efficiency, renegotiating contracts, and carefully managing pricing. Innovation and cost-cutting measures can also help sustain profitability.

Adaptability and strategic planning will be key for businesses looking to navigate inflationary pressures successfully.

| Key Point | Brief Description |

|---|---|

| 📊 Core Inflation at 3.9% | Underlying inflation remains high, impacting economic stability. |

| 💰 Consumer Impact | Reduced purchasing power necessitates budgeting and financial planning. |

| 🏦 Federal Reserve Actions | Raising interest rates and quantitative tightening to combat inflation. |

| 💼 Business Strategies | Adaptation through efficiency, contract management, and pricing. |

What is core inflation?

▼

Core inflation measures the changes in the price of goods and services, excluding food and energy. This provides a clearer view of long-term inflationary trends by removing volatile elements.

▼

High inflation erodes the real value of wages, reducing consumer purchasing power. This leads to cutbacks on non-essential spending as households prioritize essential goods and services.

▼

Businesses improve operational efficiency, renegotiate contracts, and manage pricing strategically. Innovation and cost-cutting measures help maintain profitability during inflationary periods.

▼

The Federal Reserve is raising interest rates and engaging in quantitative tightening to reduce the money supply. These measures aim to cool down economic activity and lower inflationary pressures.

▼

Individuals can create budgets to track expenses, prioritize needs over wants, and invest in assets that hold value during inflation, such as real estate or commodities. Diversification is crucial.

Conclusion

The persistent core inflation rate of 3.9% poses ongoing challenges for consumers, businesses, and policymakers. While the future trajectory of inflation remains uncertain, understanding the key drivers and adopting proactive strategies are essential for navigating the current economic landscape effectively. By staying informed and adaptable, individuals and organizations can mitigate the impact of inflation and work towards financial stability.