Dow Jones Record High: Is the Rally Sustainable?

The Dow Jones Industrial Average has recently reached a record high, prompting questions about whether this rally is sustainable in the long term, considering various economic factors.

The **Dow Jones Reaches Record High: Is This a Sustainable Rally?** That’s the question on many investors’ minds as the market continues its upward trajectory. Let’s delve into the factors driving this surge and whether it can last.

Understanding the Dow’s Record High

The Dow Jones Industrial Average’s recent climb to a record high has sparked considerable excitement and debate. Understanding the forces behind this surge is crucial for investors and market watchers alike.

Key Factors Driving the Surge

Several factors have contributed to the Dow’s impressive performance, including strong corporate earnings and positive economic data.

- Strong Corporate Earnings: Many companies have reported earnings that exceeded expectations, boosting investor confidence.

- Positive Economic Data: Favorable economic indicators, such as low unemployment rates and rising consumer spending, have fueled the rally.

- Federal Reserve Policy: The Federal Reserve’s monetary policy has played a significant role, with interest rate decisions impacting market sentiment.

These elements combined paint a picture of apparent financial health, but is there more beneath the surface?

Economic Indicators and the Dow

Economic indicators provide vital clues about the health and direction of the market, acting as barometers for sustainable or unsustainable growth.

Strong retail sales figures and consumer confidence indices are typically positive signs for the overall economy.

The Role of Inflation

Inflationary pressures can significantly impact the stock market. Rising inflation can erode corporate profits and lead to tighter monetary policies.

Unemployment Rates

Low unemployment rates often signal a healthy economy, but they can also lead to labor shortages and wage inflation. This needs careful management.

- GDP Growth: Gross Domestic Product (GDP) growth is a comprehensive measure of economic activity.

- Consumer Spending: Consumer spending accounts for a significant portion of the economy.

- Housing Market: The health of the housing market is often seen as a bellwether for the broader economy.

Careful analysis of these indicators can help determine if the records being set by the Dow are built on a firm and strong base, or something less sustainable.

Corporate Earnings and Market Valuation

Corporate earnings underpin stock prices. Understanding market valuation metrics is critical to assessing whether the Dow’s record high is justified.

Strong earnings growth supports higher valuations. However, excessive valuations compared to earnings can be a sign of a bubble

Price-to-Earnings (P/E) Ratio

The price-to-earnings ratio is a common metric used to evaluate market valuation. A high P/E ratio indicates that investors are paying a premium for earnings.

Earnings Growth Trends

Examining historical earnings growth trends can provide insights into future performance. Sustainable growth depends on consistent profitability. Are the earnings growing in a similar manner?

A strong economy combined with strong corporate earnings and reasonable ratios will paint a clearer picture for potential and current investors.

Geopolitical Factors and Global Economy

Geopolitical events and the global economy wield significant influence over financial markets, even for something as US centric as the Dow Jones.

Trade tensions can disrupt supply chains and reduce corporate profits. Political instability can create uncertainty and volatility.

Impact of Trade Policies

Trade policies, such as tariffs and trade agreements, can significantly impact corporate earnings and market sentiment.

Global Economic Growth

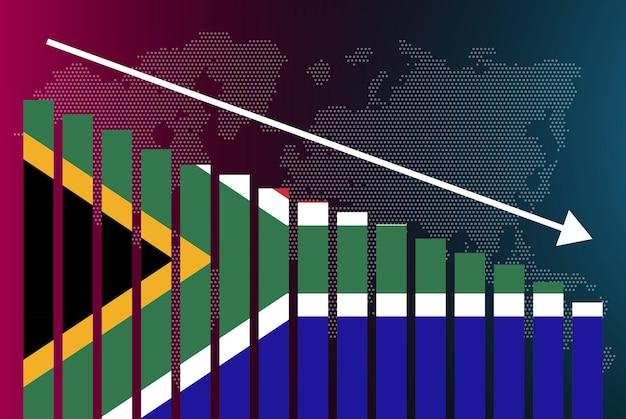

Slowdowns in global economic growth can affect the earnings of multinational corporations and dampen investor enthusiasm.

Staying aware of global matters which can cause ripples felt domestically is important for long term sustainability.

Federal Reserve and Monetary Policy

The U.S. Federal Reserve’s actions in monetary policy plays a crucial role in guiding economic trends and influencing stock market performance.

Interest Rate Adjustments

Changes in interest rates can influence borrowing costs for companies and consumers, affecting economic activity. Rates that are too high can stagnate an economy, while too low causes inflation.

Higher interest rates can dampen economic growth and reduce corporate profits. Lower rates and have the opposite effect.

Quantitative Easing (QE)

Quantitative easing involves large-scale purchases of government bonds and other assets to inject liquidity into the financial system. QE is seen a tool to provide ease to larger banks and promote investment.

- Inflation Targets: The Fed’s inflation targets guide its monetary policy decisions.

- Employment Data: The Fed closely monitors employment data to assess the health of the labor market.

The relationship The Fed has with the market is a complex one, but they must coexist to create a viable long term outlook.

Risks and Challenges Ahead

Challenges could undermine the Dow. Considering potential risks is vital for a pragmatic outlook to long term projections.

A bubble can lead to a sharp market correction. Economic slowdowns can reduce corporate profits and trigger declines.

Potential Market Correction

A market correction, a sudden and significant drop in stock prices, can occur due to various factors, including overvaluation and investor panic.

Black Swan Events

Unforeseen events, such as natural disasters or geopolitical shocks, can disrupt the market and trigger volatility.

- Interest Rate Hikes: Rapid increases in interest rates can quickly change the trajectory of the current rise.

- Slowing Global Growth: Should the global economy slow down that may affect the Dow.

Weighing the possible risks to the current period of success should be viewed as an essential step to preserving those very gains.

| Key Point | Brief Description |

|---|---|

| 📈 Record High | Dow Jones achieved a new record, sparking sustainability questions. |

| 💰 Corporate Earnings | Strong earnings are driving the surge, but valuations matter. |

| 🌍 Global Factors | Geopolitics and global growth impact market stability. |

| ⚠️ Potential Risks | Corrections, black swan events, and rate hikes pose threats. |

FAQ

The Dow’s rise is fueled by strong corporate earnings, positive economic indicators like low unemployment, and accommodative monetary policies by the Federal Reserve.

Low unemployment and controlled inflation support market stability. However, unchecked inflation and labor shortages could erode corporate profits and destabilize rapid growth.

The Federal Reserve influences the Dow through interest rate adjustments and quantitative easing, impacting borrowing costs, liquidity, and overall market sentiment.

Yes, geopolitical events, changes in trade policies, and shifts in global economic growth can significantly impact the earnings of multinational corporations and market enthusiasm.

Risks include a potential market correction, unforeseen black swan events, rapid interest rate hikes, and a slowdown in global economic growth, all of which could disrupt the market.

Conclusion

The **Dow Jones Reaches Record High: Is This a Sustainable Rally?** While current drivers look promising, a sustainable rally will depend on continued economic health, stable geopolitical conditions, and prudent monetary policy. Investors should remain vigilant, carefully monitor key indicators, and be prepared for potential risks ahead.