Boost Your Credit Score: A 6-Month Action Plan

Improving your credit score by 50 points in 6 months involves a strategic personal finance action plan focusing on timely payments, lowering credit utilization, addressing errors in your credit report, and avoiding new debt, creating a positive credit history trajectory.

Want to know how to improve your credit score by 50 points in 6 months: a personal finance action plan? Building strong credit can be easier than you think. It’s not just about luck; it’s about making smart financial choices and consistently sticking to a plan.

Understand Your Starting Point

Before diving into the steps, it’s important to understand where you currently stand. Knowing your credit score and what factors are affecting it allows you to focus your efforts effectively. It is also important to understand the importance of a good credit score and the effect it has on your life.

Check Your Credit Report

Obtain a free copy of your credit report from each of the three major credit bureaus: Experian, Equifax, and TransUnion. Review these reports carefully for any errors or discrepancies. Identifying and correcting mistakes can provide a quick boost to your credit score.

Know Your Credit Score

Use a reputable service or credit card provider to check your credit score. Keep in mind that different scoring models exist, and your score may vary slightly depending on the source. The key is to understand the factors influencing your score.

- Regularly monitoring your credit score helps you stay informed and track your progress.

- Understanding the scoring factors helps you identify areas for improvement.

- It helps you focus your efforts where they will have the most impact.

Understanding your current credit standing is essential for creating a tailored plan. Once you know your score and the details within your credit report, you can build an effective path to improvement.

Create a Realistic Budget

Budgeting is the cornerstone of any successful financial plan. It helps you track your income and expenses, enabling you to identify areas where you can save money and reduce debt. Without a solid budget, it can be challenging to improve your credit score effectively.

Track Your Income and Expenses

Use a budgeting app, spreadsheet, or notebook to record all your income and expenses. Categorize your spending to see where your money is going. This practice provides insight into your financial habits and areas to cut back.

Prioritize Debt Repayment

Allocate a portion of your budget to paying down your debts. Focus on those with the highest interest rates, as they cost you the most in the long run. Paying on time can significantly help you with your credit score.

- A practical budget helps you manage your finances effectively.

- Prioritizing debt repayment reduces interest and improves your credit utilization.

- Tracking provides insights for better financial decision-making.

Establishing a realistic budget is a fundamental step in improving your credit score. It sets the stage for consistent financial discipline and paves the way for effective debt management.

Pay Bills on Time, Every Time

Payment history is one of the most significant factors in your credit score. Consistently paying your bills on time demonstrates responsible credit management and builds trust with lenders. Late payments, even by a few days, can negatively impact your credit score.

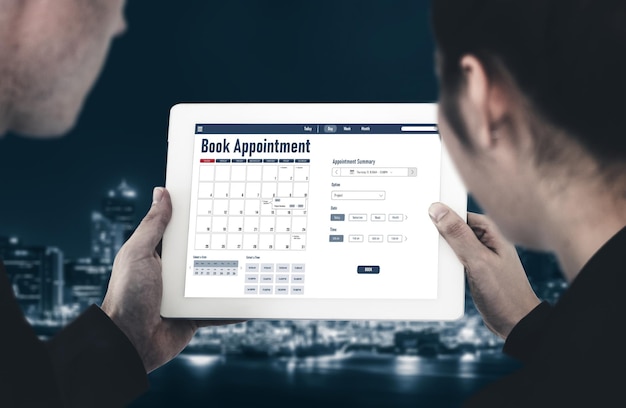

Set Up Payment Reminders

Enable payment reminders through email, text, or your bank’s mobile app. Set reminders a few days before the due date to ensure you have ample time to pay. Set reminders for all bills to make sure that you don’t miss a single payment.

Automate Your Payments

Whenever possible, enroll in automatic payments for your bills. This ensures that payments are made on time, even when you forget or are too busy. It guarantees reliability and consistency for your payees.

- Consistent payments improve your credit reputation.

- Payment reminders provide timely notifications and warnings.

- Automation eliminates the risk of forgetting payments

Making timely bill payments is a non-negotiable habit when improving your credit score. It shows lenders that you are reliable and trustworthy, ultimately boosting your creditworthiness and providing benefits in the future.

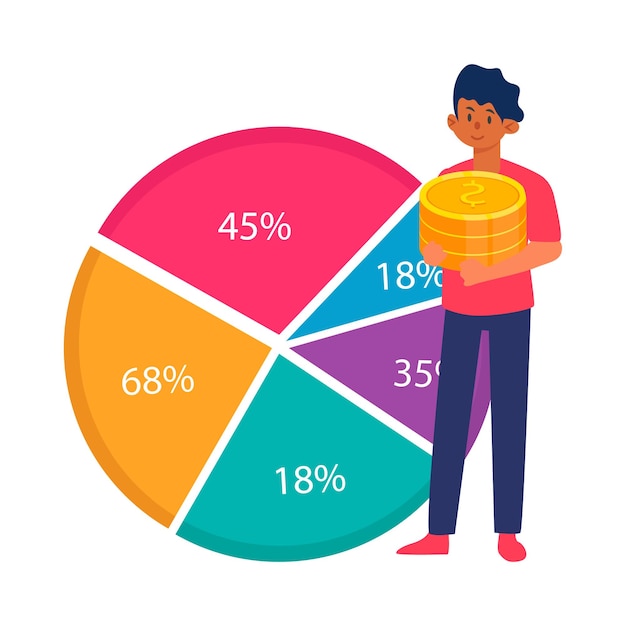

Reduce Credit Utilization

Credit utilization refers to the amount of credit you’re using compared to your total available credit. Experts recommend keeping your credit utilization below 30%. High credit utilization can signal to lenders that you are overextended, negatively impacting your credit score.

Pay Down Credit Card Balances

Make extra payments towards your credit card balances to reduce your utilization ratio. Even small additional payments can make a noticeable difference over time. Reduce your credit card usage and prioritize payments.

Request a Credit Limit Increase

Contact your credit card provider and request a credit limit increase. If approved, this can lower your credit utilization without requiring you to spend less. Increasing your credit limit creates a financial cushion.

Reducing credit utilization is a strategic move to enhance your credit score. It demonstrates responsible credit management and reassures lenders that you are capable of handling credit wisely.

Dispute Errors on Your Credit Report

As mentioned earlier, errors on your credit report can harm your credit score. Take the time to review your credit reports from all three major credit bureaus and dispute any inaccurate or incomplete information. There may be errors and mistakes being calculated into your final score.

Gather Supporting Documentation

Collect any documentation that supports your claim, such as bank statements, payment confirmations, or identity verification documents. Having evidence makes your dispute stronger. Compile the details and build you case.

Submit a Dispute Letter

Write a formal dispute letter to each credit bureau, clearly outlining the error and providing supporting documentation. Include your personal information, account number, and a detailed explanation of the issue at hand.

- Correcting errors removes inaccurate data from your credit report.

- Documentation strengthens your dispute claim.

- Follow-up ensures your dispute is being processed.

Disputing inaccuracies on your credit report is a proactive way to improve your credit score. Addressing and correcting errors can result in a significant increase in your score as a result.

Avoid Applying for New Credit

Each time you apply for new credit, a hard inquiry is placed on your credit report, which can temporarily lower your credit score. Avoid applying for multiple credit cards or loans within a short period, as this can significantly impact your creditworthiness. Focus on improving existing accounts before applying for new ones.

Prioritize Improving Existing Accounts

Instead of opening new accounts, focus on improving your existing credit card and loan accounts. Paying bills on time, reducing credit utilization, and resolving errors are all effective ways to strengthen your credit profile. You will see a positive trend in your credit report.

Be Cautious with Store Credit Cards

While store credit cards may seem appealing due to their easy approval process, they often come with high interest rates and can tempt you to overspend. Use caution when considering store credit cards and avoid opening them unless you have a clear plan for responsible usage.

- Limit new credit applications reduce negative inquiries.

- Improving existing accounts will help to bring value to your credit report with positive information.

- Responsible credit management fosters long-term credit health.

Avoiding unnecessary credit applications is crucial for maintaining a stable credit score. Focusing on responsible credit management and improving existing accounts demonstrates financial discipline and builds a strong credit profile.

| Key Point | Brief Description |

|---|---|

| 📊 Check Credit Report | Review for errors and inaccuracies. |

| 💰 Create a Budget | Track income/expenses, prioritize debt. |

| 🗓️ Pay Bills On Time | Set reminders/automate payments. |

| 💳 Reduce Utilization | Pay down balances, request higher limit. |

FAQ

▼

At a minimum, you should check your credit report once a year, but ideally, aim for every four months by staggering your requests across the three major credit bureaus.

▼

A good credit utilization ratio is typically below 30%. For example, if you have a credit card with a $1,000 limit, aim to keep the balance below $300.

▼

Late payments can impact your credit score once they are reported to the credit bureaus, which is typically after 30 days past the due date.

▼

If you find an error, gather all relevant documentation to support your case and dispute the error with the credit bureau that issued the report.

▼

Closing a credit card can potentially lower your credit score, especially if it reduces your overall available credit and increases your credit utilization ratio.

Conclusion

Improving your credit score by 50 points in 6 months requires a combination of responsible financial habits and strategic actions. By understanding your current financial situation, creating a budget, paying bills on time, reducing credit utilization, disputing errors on your credit report, and avoiding new credit applications, you can gradually enhance your creditworthiness and unlock various financial opportunities.