Investing in Series I Bonds: Your Safe Haven with 9.62% Interest

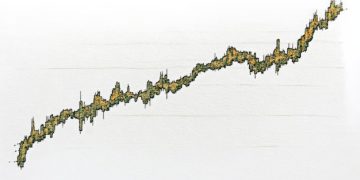

Investing in Series I Bonds offers a secure investment avenue, particularly during times of economic uncertainty, guaranteeing a 9.62% interest rate for a specified period, making them an attractive option for those seeking stable returns.

Looking for a safe investment that offers a guaranteed high-interest rate? Then, consider investing in Series I Bonds: A Safe Haven with a Guaranteed 9.62% Interest Rate for the Next 6 Months. These bonds, issued by the U.S. Department of the Treasury, provide a unique combination of safety and competitive returns, making them an attractive option for both seasoned investors and beginners.

Understanding Series I Bonds

Series I Bonds are a type of U.S. government savings bond designed to protect investors’ purchasing power from inflation. They earn interest based on a combination of a fixed rate, which remains constant for the life of the bond, and an inflation rate, which is adjusted twice a year. This structure makes them a popular choice for those seeking a low-risk investment that keeps pace with rising prices.

How Series I Bonds Work

When you purchase a Series I Bond, you’re essentially lending money to the U.S. government. In return, you receive a bond that earns interest over time. The interest rate is composed of two parts: a fixed rate and an inflation rate. The fixed rate remains the same for the life of the bond, while the inflation rate is based on the Consumer Price Index for all Urban Consumers (CPI-U).

Benefits of Investing in Series I Bonds

Investing in Series I Bonds offers several advantages, including safety, inflation protection, and tax benefits. They are considered one of the safest investments available because they are backed by the full faith and credit of the U.S. government. Additionally, the inflation-adjusted interest rate helps preserve your purchasing power.

- Safety: Backed by the U.S. government, making them virtually risk-free.

- Inflation Protection: Interest rate adjusts to keep pace with inflation.

- Tax Advantages: Federal income tax is deferred until you redeem the bond, and they are exempt from state and local taxes.

In conclusion, Series I Bonds offer a compelling investment option for risk-averse individuals looking to protect their savings from inflation while benefiting from tax advantages and the security of government backing.

The Allure of the 9.62% Interest Rate

The current 9.62% interest rate on Series I Bonds has captured the attention of investors nationwide. This high rate is a direct result of the recent surge in inflation, making these bonds particularly attractive in today’s economic climate. This rate is not guaranteed to last forever, as the inflation component can change every six months.

Understanding the Interest Rate Calculation

The 9.62% interest rate is a composite rate that combines a fixed rate and an inflation rate. For example, based on the latest announcement, the fixed rate might be 0.00% and the inflation rate might be 4.81%. The composite rate will be 9.62% (This rate may vary depending on the time of the issue of the bond). The inflation rate is based on the CPI-U and is adjusted every six months, reflecting changes in the cost of living.

Why This Rate is Significant

In a low-interest-rate environment, a guaranteed 9.62% return is exceptionally high. It provides investors with a rare opportunity to earn a substantial return on a risk-free investment. This rate can significantly boost savings growth, especially for those with long-term financial goals.

The exceptional 9.62% interest rate on Series I Bonds provides a unique opportunity for investors to secure a high return while hedging against inflation, making them a standout choice in today’s market.

Who Should Invest in Series I Bonds?

Series I Bonds are suitable for a wide range of investors, but they are particularly beneficial for those who prioritize safety and inflation protection. Retirees, conservative investors, and individuals saving for long-term goals like education or a down payment on a house can find them to be a valuable addition to their portfolios.

Ideal Candidates for Series I Bonds

Those nearing or in retirement can benefit from the stability and inflation-adjusted returns of Series I Bonds. These bonds can help retirees maintain their purchasing power and provide a reliable income stream.

When to Consider Other Investment Options

While Series I Bonds offer attractive benefits, they may not be the best choice for everyone. Investors seeking higher growth potential or those with shorter time horizons might consider other investment options, such as stocks or mutual funds. It’s essential to assess your individual financial goals and risk tolerance before making any investment decisions.

- Retirees: Provide a safe and reliable income stream.

- Conservative Investors: Offer a low-risk investment option.

- Long-Term Savers: Help preserve purchasing power over time.

In conclusion, Series I Bonds are an excellent choice for individuals who prioritize safety, inflation protection, and tax advantages, but they may not be the ideal investment for those seeking higher growth or with shorter investment horizons.

How to Purchase Series I Bonds

Purchasing Series I Bonds is a straightforward process that can be done online through the TreasuryDirect website. This platform allows individuals to buy, manage, and redeem their bonds electronically. Understanding the purchase process and any limitations is essential to maximize the benefits of this investment.

Step-by-Step Guide to Buying Bonds on TreasuryDirect

To purchase Series I Bonds, you’ll first need to create an account on the TreasuryDirect website. Once your account is set up, you can navigate to the “BuyDirect” section and select Series I Bonds. You’ll then specify the amount you want to purchase and choose your payment method. The minimum purchase amount is $25, and the maximum annual purchase is $10,000 per individual.

Limitations and Restrictions

As with any investment, there are some limitations and restrictions to be aware of when purchasing Series I Bonds. The annual purchase limit of $10,000 per person can be a constraint for some investors. Additionally, you cannot redeem the bonds within the first year of purchase, and if you redeem them before five years, you’ll forfeit the last three months of interest.

Purchasing Series I Bonds involves a simple online process through TreasuryDirect, but it’s important to be aware of the purchase limits and redemption restrictions to ensure they align with your financial goals and investment strategy.

Tax Implications of Series I Bonds

Series I Bonds offer unique tax advantages that can be beneficial for investors. Understanding these tax implications is essential for effectively managing your investment and maximizing your returns. Federal income tax is deferred until you redeem the bond, and they are exempt from state and local taxes.

Federal Income Tax Deferral

One of the primary tax benefits of Series I Bonds is the ability to defer federal income tax until you redeem the bond or it matures. This means you won’t have to pay taxes on the interest earned each year. Instead, you can defer those taxes until you cash out the bond, which can be advantageous if you anticipate being in a lower tax bracket in the future.

State and Local Tax Exemption

In addition to federal tax deferral, Series I Bonds are exempt from state and local taxes. This can result in significant tax savings, especially for individuals living in states with high income tax rates. The combination of federal tax deferral and state and local tax exemption makes Series I Bonds an attractive tax-advantaged investment.

- Federal Tax Deferral: Defer paying federal income tax until redemption.

- State and Local Tax Exemption: Exempt from state and local taxes.

- Education Tax Exclusion: Interest may be tax-free if used for qualified education expenses.

Understanding the tax implications of Series I Bonds can help investors make informed decisions and maximize the tax benefits, contributing to overall financial well-being.

Alternatives to Series I Bonds

While Series I Bonds offer a unique combination of safety and inflation protection, it’s essential to consider other investment alternatives that may be more suitable depending on your financial goals and risk tolerance. Treasury Inflation-Protected Securities (TIPS), high-yield savings accounts, and certificates of deposit (CDs) are some alternatives to consider.

Treasury Inflation-Protected Securities (TIPS)

TIPS are another type of U.S. government security that is designed to protect investors from inflation. Unlike Series I Bonds, TIPS are sold on the secondary market and their principal is adjusted based on changes in the CPI. While TIPS also offer inflation protection, their interest rates may vary and they are subject to market fluctuations.

High-Yield Savings Accounts and Certificates of Deposit (CDs)

High-yield savings accounts and CDs are bank products that offer fixed interest rates and FDIC insurance. While these options may not provide the same level of inflation protection as Series I Bonds, they can be a good choice for individuals who need easy access to their funds or prefer the simplicity of a fixed interest rate.

Consider alternatives to Series I Bonds, such as TIPS, high-yield savings accounts, and CDs, to tailor your investment strategy to your specific needs and financial goals.

| Key Point | Brief Description |

|---|---|

| 🛡️ Safety | Backed by the full faith and credit of the U.S. Government. |

| 📈 High Interest | Currently offering a 9.62% interest rate, adjusted for inflation. |

| 💰 Tax Benefits | Federal income tax is deferred; exempt from state and local taxes. |

| 🛒 Purchase Limit | Limited to $10,000 per person per year. |

Frequently Asked Questions (FAQ)

▼

Series I Bonds are U.S. government savings bonds designed to protect your money from inflation. They earn interest based on a fixed rate plus an inflation rate, adjusted twice a year.

▼

The interest rate is a combination of a fixed rate, which remains constant for the life of the bond, and an inflation rate, which is based on the Consumer Price Index (CPI-U).

▼

You can purchase Series I Bonds online through the TreasuryDirect website. You’ll need to create an account to buy, manage, and redeem your bonds electronically.

▼

Federal income tax is deferred until you redeem the bond, and they are exempt from state and local taxes. There may also be an education tax exclusion if used for qualified expenses.

▼

Yes, the annual purchase limit is $10,000 per person. You cannot redeem the bonds within the first year, and early redemption before five years forfeits three months of interest.

Conclusion

Investing in Series I Bonds presents a compelling opportunity to secure your financial future with a safe, inflation-protected, and tax-advantaged investment. The current high-interest rate makes them particularly attractive, but it’s essential to consider your individual financial goals and consult with a financial advisor to determine if they align with your overall investment strategy.