Consumer Confidence Soars to 105: Is the US Economy Back on Track?

The Consumer Confidence Index surged to 105, sparking debates about whether this indicates a genuine recovery of the U.S. economy or if underlying factors suggest a more cautious outlook.

The Consumer Confidence Index Rises to 105: Is the US Economy Recovering? This recent surge has economists and consumers alike asking whether this signifies a genuine economic resurgence or just a temporary blip.

Understanding the Consumer Confidence Index (CCI)

The Consumer Confidence Index (CCI) is a crucial economic indicator. It serves as a barometer of how optimistic or pessimistic consumers are regarding the economy’s future.

A higher CCI typically suggests that consumers are more willing to spend money. This spending drives economic growth, while a lower CCI indicates caution and potentially reduced spending.

How the CCI is Calculated

The CCI is derived from a monthly survey. This survey measures consumers’ feelings about current and future economic conditions.

Key Components of the CCI

The index comprises two main components that influence the overall score.

- Present Situation Index: Reflects consumers’ assessment of current business and labor market conditions.

- Expectations Index: Gauges consumers’ expectations for income, business, and labor market conditions over the next six months.

Understanding these components is critical when analizing the CCI.

In conclusion, the CCI serves as a vital tool for economists and policymakers to gauge the pulse of the economy through the eyes of the consumer.

Breaking Down the Latest CCI Increase to 105

The recent increase in the Consumer Confidence Index to 105 is significant. It has caught the attention of economists and market analysts. But what does this specific number really mean?

A reading of 100 is generally considered neutral. Any number above 100 indicates optimism, while below 100 suggests pessimism.

Factors Contributing to the Rise

Several factors could be driving this increase in consumer confidence.

- Improved Labor Market: A decrease in unemployment rates and steady job growth can boost consumer sentiment.

- Rising Wages: Increased earnings give consumers more disposable income, leading to higher confidence.

- Stock Market Performance: A strong stock market can increase consumers’ sense of wealth and financial security.

These factors contribute to an overall feeling of security.

In summary, the increase to 105 suggests a more optimistic outlook among consumers, driven by several interconnected economic factors.

Positive Indicators: Signs of a Genuine Recovery

Analyzing specific economic indicators alongside consumer confidence can reveal the health of the economy.

Positive trends in these areas could confirm that the consumer confidence increase is supported by real improvements.

Employment Growth

Sustained job creation is a strong signal of economic health.

Housing Market Rebound

An increase in housing starts and sales can indicate a recovery.

These are significant factors.

Manufacturing Expansion

Growth in manufacturing activity often suggests broader economic improvement.

In brief, positive trends in employment, housing, and manufacturing can reinforce the idea that the rise in consumer confidence reflects an actual recovery.

Potential Concerns: Factors Suggesting Caution

Despite the positive CCI, caution is warranted. Certain factors could undermine the sustainability of this confidence.

It’s essential to consider these potential pitfalls to gain a balanced perspective.

Inflationary Pressures

Rising prices can erode consumer purchasing power and confidence.

Geopolitical Instability

Global events can create economic uncertainty and impact consumer sentiment.

Interest Rate Hikes

The Federal Reserve’s actions can affect consumers’ borrowing costs.

These are some considerations.

In conclusion, while the CCI increase is encouraging, ongoing inflationary pressures, geopolitical instability, and rising interest rates require careful monitoring.

Expert Opinions: What Economists Are Saying

Expert opinions on the CCI provide valuable insights and different perspectives.

Comparing viewpoints can lead to a more comprehensive understanding of the situation.

Optimistic Views

Some economists believe the CCI signals a strong, sustainable recovery.

Cautious Views

Other experts are more cautious, citing potential risks.

- Overstated Optimism: The CCI may not fully reflect underlying economic vulnerabilities.

- Temporary Factors: The increase could be due to short-term influences that may not last.

These views are backed by historical evidence.

In summary, economists’ opinions range from optimistic to cautious, highlighting the complexity of interpreting the CCI and its implications for the U.S. economy.

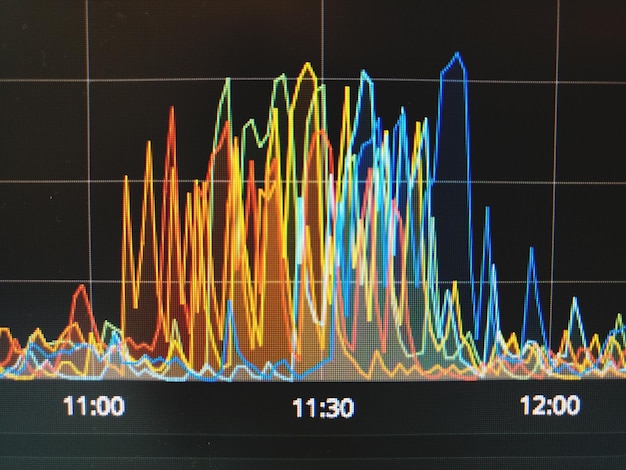

How the CCI Impacts Financial Markets and Consumer Behavior

The Consumer Confidence Index has a direct impact on financial markets and consumer behavior.

Understanding these effects is crucial for investors and businesses alike.

Stock Market Reactions

A rising CCI often leads to increased stock market activity.

Consumer Spending Patterns

Higher consumer confidence typically translates into increased spending.

Business Investment

Businesses tend to invest more when consumer confidence is high.

Ultimately, the CCI serves as a leading indicator that drives significant shifts in financial markets and consumer behavior, influencing economic outcomes.

| Key Point | Brief Description |

|---|---|

| 📈 CCI at 105 | Indicates consumer optimism about the economy. |

| 💼 Labor Market | Improved job market boosts confidence. |

| ⚠️ Inflation | Rising prices can threaten consumer sentiment. |

| 💰 Spending | Higher confidence leads to increased consumer spending. |

Frequently Asked Questions (FAQ)

▼

The Consumer Confidence Index (CCI) is an economic indicator that measures consumers’ level of optimism about the economy. It’s based on a monthly survey of households.

▼

The CCI is calculated from survey responses regarding consumers’ views on current business conditions, labor market, and expectations for the next six months.

▼

A CCI of 105 suggests that consumers are generally optimistic about the economy. A reading above 100 indicates positive sentiment, while below 100 suggests pessimism.

▼

Various factors can influence the CCI, including job growth, wage increases, stock market performance, inflation rates, and geopolitical events.

▼

The CCI can influence financial markets by affecting stock market activity, consumer spending patterns, and business investment decisions, driven by the overall confidence level.

Conclusion

In conclusion, the recent rise in the Consumer Confidence Index Rises to 105: Is the US Economy Recovering? is a complex indicator of the economic climate. While it suggests increased optimism among consumers, various underlying factors such as inflation, global instability, and expert reservations call for a measured approach to interpreting its implications. Continued monitoring of these aspects will provide a clearer picture of whether this confidence translates into a sustained economic recovery.