Navigating Medicare Enrollment: Your 2025 Comprehensive Guide

Navigating Medicare Enrollment: A Comprehensive Guide for 2025 offers a clear pathway through the enrollment process, covering eligibility, enrollment periods, plan options, and essential tips to ensure you make informed decisions about your healthcare needs for the upcoming year.

Planning for healthcare in 2025? Navigating Medicare Enrollment: A Comprehensive Guide for 2025 is your essential resource. This guide simplifies the complexities of Medicare enrollment, enabling you to make informed decisions about your healthcare coverage.

Understanding Medicare Eligibility for 2025

Understanding who qualifies for Medicare is the first step in the enrollment process. Medicare provides health insurance for individuals aged 65 or older, as well as some younger people with disabilities or certain medical conditions. Knowing the specific eligibility requirements will help you determine when and how you can enroll.

Age Requirements

The most common way to qualify for Medicare is by age. Generally, you are eligible for Medicare at age 65 if you are a U.S. citizen or have been a legal resident for at least 5 years. You or your spouse must also have worked for at least 10 years (40 quarters) in Medicare-covered employment.

Disability and Medical Conditions

Individuals under 65 may also qualify for Medicare if they have certain disabilities or medical conditions. This includes people with amyotrophic lateral sclerosis (ALS), also known as Lou Gehrig’s disease, and those with end-stage renal disease (ESRD) requiring dialysis or a kidney transplant.

- Confirm your eligibility based on age, disability, or medical condition.

- Gather necessary documents such as proof of age and citizenship.

- Understand how your work history affects your premium costs.

In summary, Medicare eligibility hinges on age, disability, or specific medical conditions. Ensuring you meet these criteria and gathering the necessary documentation will smooth your path to enrollment.

Key Enrollment Periods for Medicare in 2025

Medicare enrollment isn’t a continuous process; it operates within specific enrollment periods. Knowing these periods is crucial to avoid penalties and ensure you have coverage when you need it. Each period has its own rules and requirements, so it’s essential to understand them.

Initial Enrollment Period (IEP)

Your IEP is a 7-month window that includes the 3 months before your 65th birthday, the month of your birthday, and the 3 months after. This is the primary time to enroll in Medicare Part A and Part B without penalty.

General Enrollment Period (GEP)

The GEP runs from January 1 to March 31 each year. It’s for those who didn’t enroll during their IEP. However, enrolling during the GEP may result in a late enrollment penalty.

Special Enrollment Period (SEP)

SEPs are triggered by specific life events, such as losing employer-sponsored health coverage or moving out of your plan’s service area. SEPs allow you to enroll in Medicare outside the standard enrollment periods.

- Mark key enrollment periods on your calendar to avoid missing deadlines.

- Understand the implications of enrolling outside your IEP.

- Know which life events qualify you for a SEP.

In conclusion, understanding the various Medicare enrollment periods is vital for securing coverage when you need it and avoiding potential penalties. Knowing when each period occurs and what triggers them will help you plan effectively.

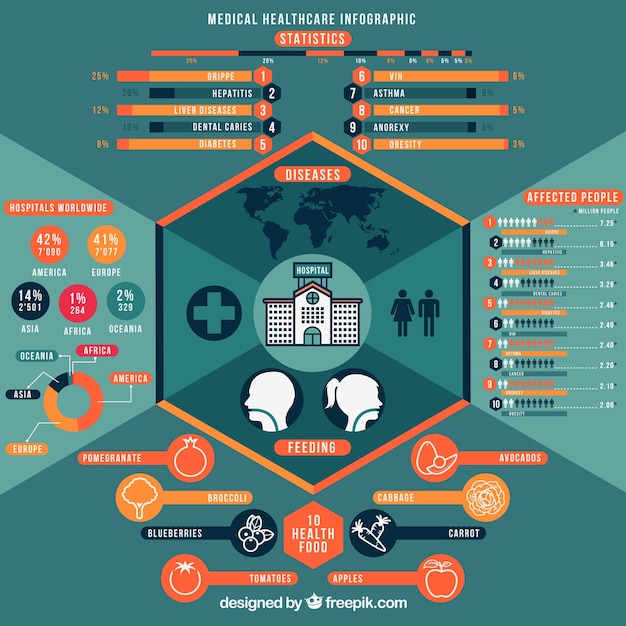

Understanding Medicare Parts A, B, C, and D

Medicare is divided into several parts, each covering different aspects of healthcare. Parts A and B are often referred to as Original Medicare, while Parts C and D offer additional coverage options. Understanding what each part covers will help you choose the right plan for your needs.

Medicare Part A: Hospital Insurance

Part A covers inpatient hospital stays, skilled nursing facility care, hospice care, and some home health care. Most people don’t pay a monthly premium for Part A if they or their spouse have worked long enough to qualify.

Medicare Part B: Medical Insurance

Part B covers doctor visits, outpatient care, preventive services, and some medical equipment. Most people pay a monthly premium for Part B, which can vary depending on income.

Medicare Part C: Medicare Advantage

Part C, also known as Medicare Advantage, is offered by private insurance companies approved by Medicare. These plans combine Part A and Part B coverage and often include additional benefits like vision, dental, and hearing care.

Medicare Part D: Prescription Drug Coverage

Part D helps cover the cost of prescription drugs. It’s offered by private insurance companies and requires an additional monthly premium. Enrollment in Part D is optional but recommended to avoid late enrollment penalties later.

- Evaluate your healthcare needs to determine which parts of Medicare are most important for you.

- Compare the benefits and costs of different Medicare Advantage and Part D plans.

- Understand how each part of Medicare works together to provide comprehensive coverage.

Comprehending the differences between Medicare Parts A, B, C, and D is crucial for tailoring your coverage to your specific health needs. Each part offers unique benefits, and choosing the right combination can greatly enhance your healthcare experience.

Choosing Between Original Medicare and Medicare Advantage

One of the most important decisions you’ll make during Medicare enrollment is whether to choose Original Medicare or a Medicare Advantage plan. Each option has its own set of advantages and disadvantages, so it’s important to weigh them carefully.

Original Medicare

Original Medicare allows you to see any doctor or hospital that accepts Medicare, anywhere in the U.S. It consists of Part A and Part B and typically requires you to pay a deductible and coinsurance for services.

Medicare Advantage

Medicare Advantage plans, offered by private insurers, often have lower out-of-pocket costs and may include extra benefits like vision, dental, and hearing care. However, they usually require you to use a network of doctors and hospitals.

Consider Your Healthcare Needs

Think about your healthcare needs and preferences when making your decision. If you value flexibility and the ability to see any doctor, Original Medicare may be the better choice. If you prioritize lower costs and additional benefits, a Medicare Advantage plan could be more suitable.

- Evaluate your healthcare usage, including doctor visits, hospital stays, and prescription drug needs.

- Compare the costs of Original Medicare and Medicare Advantage plans, including premiums, deductibles, and copays.

- Consider whether you prefer the freedom to see any doctor or hospital or if you’re comfortable using a network.

Making an informed choice between Original Medicare and Medicare Advantage requires careful consideration of your individual healthcare needs and preferences. Weighing the pros and cons of each option will help you select the plan that best fits your lifestyle and health requirements.

Tips for a Smooth Medicare Enrollment Process

Medicare enrollment can be complex, but with the right preparation and knowledge, you can navigate the process smoothly. Here are some key tips to ensure a hassle-free enrollment experience.

Gather Necessary Documentation

Before you start the enrollment process, gather all the necessary documentation, including your Social Security card, birth certificate, and any information about current or past health insurance coverage. This will help expedite the application process.

Research Your Options Early

Don’t wait until the last minute to research your Medicare options. Start exploring different plans and coverage choices well in advance of your enrollment period. This will give you ample time to compare plans and make an informed decision.

Seek Professional Advice

If you find the Medicare enrollment process overwhelming, consider seeking assistance from a qualified insurance agent or counselor. They can provide personalized guidance and help you choose the right plan for your needs.

- Start the enrollment process early to avoid rushing or making hasty decisions.

- Utilize online resources and tools to compare different Medicare plans and coverage options.

- Keep detailed records of your enrollment process, including application forms and confirmation letters.

Achieving a seamless Medicare enrollment experience involves preparation, research, and seeking help when needed. By following these tips, you can confidently navigate the enrollment process and secure the healthcare coverage that’s right for you.

Avoiding Common Medicare Enrollment Mistakes

Enrolling in Medicare involves several important decisions, and it’s easy to make mistakes along the way. Being aware of common pitfalls can help you avoid costly errors and ensure you get the coverage you need.

Missing Enrollment Deadlines

One of the most common mistakes is missing enrollment deadlines. Failing to enroll during your Initial Enrollment Period or the General Enrollment Period can result in late enrollment penalties and delays in coverage.

Underestimating Your Healthcare Needs

Many people underestimate their healthcare needs when choosing a Medicare plan. It’s important to consider your current health status, medical history, and future healthcare needs to select the right coverage.

Ignoring Prescription Drug Coverage

Ignoring Part D prescription drug coverage can be a costly mistake. Even if you don’t currently take prescription drugs, enrolling in Part D when you’re first eligible can help you avoid late enrollment penalties later on.

- Double-check all enrollment deadlines and mark them on your calendar.

- Carefully evaluate your healthcare needs and preferences before choosing a plan.

- Consider enrolling in Part D prescription drug coverage, even if you don’t currently need it.

Avoiding common Medicare enrollment mistakes requires vigilance and careful decision-making. By understanding these pitfalls and taking steps to avoid them, you can ensure a smooth and successful enrollment experience.

| Key Aspect | Brief Description |

|---|---|

| 📅 Enrollment Periods | Understand IEP, GEP, and SEP to enroll timely. |

| ⚕️ Medicare Parts | Know what Parts A, B, C, and D cover. |

| ⚖️ Original vs. Advantage | Choose between flexibility and added benefits. |

| ⚠️ Avoid Mistakes | Avoid missing deadlines and underestimating needs. |

Frequently Asked Questions (FAQ)

▼

The IEP is a 7-month period around your 65th birthday, including the 3 months before, the month of, and the 3 months after. This is when you can first sign up for Medicare Parts A and B.

▼

Medicare Part A is hospital insurance. It covers inpatient hospital stays, skilled nursing facility care, hospice care, and some home health care services. Most people don’t pay a monthly premium.

▼

Medicare Part B is medical insurance. It covers doctor visits, outpatient care, preventive services, and some medical equipment. Enrollees typically pay a monthly premium for Part B coverage.

▼

Medicare Advantage plans combine Part A and Part B coverage and often include extra benefits like vision, dental, and hearing. These plans are offered by private insurance companies approved by Medicare.

▼

Medicare Part D helps cover the cost of prescription drugs. It’s offered by private insurance companies and requires an additional monthly premium. Enrollment in Part D is optional but recommended.

Conclusion

Navigating Medicare enrollment for 2025 can seem complex, but with thorough preparation and a clear understanding of your options, you can make informed decisions that best suit your healthcare needs. Utilize this guide as a starting point to ensure a smoother, more confident enrollment experience.