US Treasury Yields Surge: Expert Investment Strategies Revealed

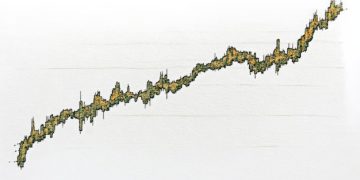

US Treasury yields have recently surged to 4.8%, prompting expert analysis and the formulation of new investment strategies to navigate potential market impacts and capitalize on emerging opportunities. The recent surge in US Treasury yields to 4.8% has sent ripples through the financial markets, prompting investors and analysts to reassess their strategies. This article delves […]

Consumer Confidence Soars to 105: Is the US Economy Back on Track?

The Consumer Confidence Index surged to 105, sparking debates about whether this indicates a genuine recovery of the U.S. economy or if underlying factors suggest a more cautious outlook. The Consumer Confidence Index Rises to 105: Is the US Economy Recovering? This recent surge has economists and consumers alike asking whether this signifies a genuine […]

Federal Reserve Rate Hike: Impact on Your 2025 Investments

The Federal Reserve’s recent decision to raise interest rates by 0.25% is poised to have a significant effect on investment strategies in 2025, influencing everything from bond yields and stock valuations to real estate and savings accounts. The Federal Reserve has announced a 0.25% interest rate hike, a move that will ripple through the financial […]

Unemployment Benefits in 2025: Key Changes You Need to Know

New Changes to Unemployment Benefits in 2025: What You Need to Know Now addresses crucial updates to unemployment benefits, including eligibility criteria, application processes, benefit amounts, and duration, ensuring individuals are well-informed and prepared for potential changes impacting their financial stability. Navigating unemployment can be challenging, especially with evolving regulations. Understanding the New Changes to […]

Understanding the Child Tax Credit: 2025 Eligibility & Strategies

Understanding the Child Tax Credit (CTC) for 2025 involves navigating eligibility requirements based on income and dependents, and employing effective claiming strategies to maximize benefits, potentially offering substantial financial relief to eligible families. The Understanding the Child Tax Credit: Eligibility and Claiming Strategies for 2025 is crucial for families seeking financial assistance. This article dives […]

Maximize Your Savings: A Step-by-Step Guide to the Dependent Care Tax Credit in 2025

Maximize Your Savings: A Step-by-Step Guide to Utilizing Dependent Care Tax Credit in 2025 offers a comprehensive overview of eligibility, application, and strategic planning to leverage this valuable tax benefit for qualifying childcare expenses. Are you a working parent juggling childcare expenses? The Maximize Your Savings: A Step-by-Step Guide to Utilizing Dependent Care Tax Credit […]