The Power of Compounding: Grow $5,000 to $50,000 in 20 Years

The Power of Compounding: How Starting with $5,000 Can Grow to $50,000 in 20 Years demonstrates the potential of long-term investing, illustrating how the snowball effect of compounding interest can turn a modest initial investment into a substantial sum over two decades.

Have you ever wondered how a small initial investment could potentially transform into a significant sum over time? The power of compounding: how starting with $5,000 can grow to $50,000 in 20 years is a testament to the remarkable potential of long-term investing and the magic of compound interest.

Understanding the Magic of Compounding

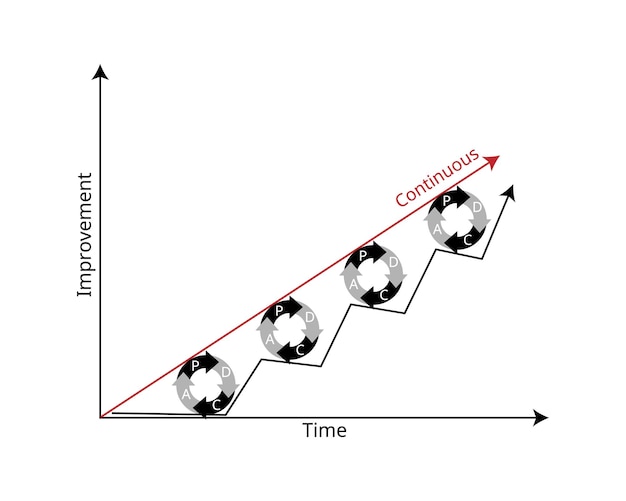

Compounding is often referred to as the eighth wonder of the world, and for good reason. It’s the process where the earnings from an investment generate further earnings, leading to exponential growth over time. This section explores the fundamental principles of compounding and how it works.

What is Compound Interest?

Compound interest is interest calculated on the initial principal, which also includes all of the accumulated interest from previous periods on a deposit or loan. Compounding in its best form has the potential to create a snowball effect, as the interest earned starts to generate more interest.

The Formula for Compound Interest

The formula that determines compound interest and all of its complex growth is A = P (1 + r/n)^(nt). Understanding each component of this formula is crucial for grasping how compounding works. Here is a breakdown:

- ✅ A = the future value of the investment/loan, including interest

- ✅ P = the principal investment amount (the initial deposit or loan amount)

- ✅ r = the annual interest rate (as a decimal)

- ✅ n = the number of times that interest is compounded per year

- ✅ t = the number of years the money is invested or borrowed for

With a beginning balance of $5,000 assuming that you never add any more funds to compounding at a rate of 12% annually you would have a total of $48,231.47 at year 20 utilizing the formula.

Compounding isn’t magical of course, more frequent compounding intervals could lead to higher returns because the interest is added back to the principal more often, allowing it to earn interest on itself more quickly. The higher the interest rate is, the quicker it adds up.

Setting the Stage: $5,000 as Your Starting Point

Starting with $5,000 might seem like a small amount, but it can be a substantial foundation for building long-term wealth through the power of compounding. This section discusses the importance of starting early and the mindset needed for successful long-term investing.

Why Start Early?

The earlier you begin investing, the more time your money has to grow through compounding. Even small contributions made consistently over time can lead to significant returns due to the exponential nature of compounding. Time is one of the investors best allies to increase the potential value of an investment.

Developing an Investment Mindset

Successful long-term investing requires patience, discipline, and a focus on the long game. It’s essential to avoid emotional decision-making, stick to your investment plan, and resist the urge to chase short-term gains. Don’t try to “get rich quick”, it’s a marathon not a sprint.

Starting with a smaller initial investment can also help investors develop the necessary skills of balancing a portfolio of investments or even a retirement account for retirement planning. A small amount isn’t going to hurt as much, but can teach valuable financial literacy.

With $5,000 invested it’s important to remember that you may not become rich overnight, but consistent planning can help set you up for a long future.

Choosing the Right Investment Vehicles

Selecting the right investment vehicles is crucial for maximizing the potential of compounding. This section explores various investment options and how they can contribute to achieving your financial goals. There are a few choices to make to get started investing.

Stocks

Investing in stocks can provide the potential for high returns, but it also comes with a higher level of risk. Diversifying your stock portfolio and focusing on long-term growth can help mitigate risk and enhance the power of compounding. An investor with a high risk tolerance might consider this option.

Bonds

Bonds are generally considered less risky than stocks and can provide a steady stream of income. While the returns may be lower, bonds can still contribute to compounding, especially when reinvested. Many retirement accounts have an allocation to this investment option.

Index funds and ETFs (exchange traded funds) are some of the lowest cost ways to get started investing. They include large allocations of stocks and bonds based on the risk tolerance of each fund.

- ✅ Index funds track a specific market index, such as the S&P 500, providing broad market exposure at a low cost.

- ✅ ETFs are similar to index funds but can be traded like stocks, providing greater flexibility and liquidity.

- ✅ Other investments include high-yield savings accounts, certificate of deposits, and money market accounts.

While there are many possibilities of what you can invest in, it’s more important that you start now instead of waiting. All of them can compound, but it really depends on the amount of risk that you’re willing to allow.

Calculating the Numbers: Interest Rates and Time

Understanding the impact of interest rates and time on compounding is essential for setting realistic expectations. This section delves into the math behind compounding and how these factors influence your investment growth.

The Impact of Interest Rates

Even small differences in interest rates can have a significant impact on the long-term growth of your investments. Higher interest rates accelerate the compounding process, leading to faster wealth accumulation. Don’t put all of your eggs in one basket, diversify for the best possibility.

The Power of Time

The longer your money is invested, the more time it has to compound. Even if you start with a small amount or earn a modest interest rate, the effects of compounding can be substantial over several years. There is a famous quote that goes “The best time to plant a tree was 20 years ago. The second best time is now.”

To help illustrate the impact of time, consider these points:

- ✅ Starting early can benefit for compounding and reaching financial freedom

- ✅ Small contributions are an easy way to get started

- ✅ Financial planning is essential to understanding your end goal

Investing your money with the power of compounding can be an amazing opportunity that some investors might consider to change their lives.

Strategies to Accelerate Compounding

While time and interest rates are key factors, there are also strategies you can implement to boost the power of compounding. This section explores ways to maximize your returns and reach your financial goals faster.

Reinvesting Dividends

If you invest in dividend-paying stocks or funds, reinvesting those dividends can significantly enhance your compounding. The dividends contribute to your principal, which then generates further earnings. It might seem simple, but don’t underestimate it.

Dollar-Cost Averaging

Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of market conditions. This strategy can help reduce risk and take advantage of market fluctuations, potentially leading to higher returns over time.

While dollar-cost averaging might not seem like an easy way to increase investment, it does increase the portfolio overtime with little effort.

Other easy to use strategies to assist compounding include:

- ✅ Set financial goals and then create a realistic portfolio

- ✅ Seek help from financial advisors if you are stuck with growing wealth

- ✅ Maximize any accounts that offer matched contributions, like 401ks

Investing can be simple or complicated, but you can find the niche that fits best for you.

Real-Life Examples and Scenarios

To further illustrate the potential of compounding, this section presents real-life examples and scenarios. These examples demonstrate how ordinary individuals have successfully grown their investments over time through the power of compounding.

The Story of John and Mary

Let’s consider two hypothetical investors, John and Mary. John starts investing $5,000 at age 25 and contributes $200 per month. Mary starts at age 35, investing $5,000 and contributing $300 per month. Assuming an average annual return of 8%, John will have significantly more money at retirement due to starting earlier.

Turning $5,000 into $50,000

To reach a goal of turning $5,000 into $50,000 in 20 years, you would need an average annual return of approximately 12%. While this isn’t guaranteed, it’s achievable through a diversified portfolio of stocks and other investments. This is also assuming that there is no additional monthly amount added into the portfolio. Adding to it will only shorten the time period to meet the end goal.

This example shows a hypothetical investor how to plan to get the best outcome, though real life results may vary the numbers are based of historical data. This is in no way a financial investment recommendation.

Compounding isn’t a way to get rich quick, but with the patience and long-term investing ideas then anyone can do this with knowledge and planning.

| Key Point | Brief Description |

|---|---|

| 🌱 Starting Early | Begin investing as soon as possible to maximize compounding effects. |

| 📊 Investment Vehicles | Choose wisely between stocks, bonds, and index funds for balanced growth. |

| ⏱️ Time & Interest | Understand how these factors drive compounding and investment growth. |

| 🔄 Reinvest Dividends | Reinvest dividends to accelerate compounding and increase investment value. |

Frequently Asked Questions (FAQ)

▼

Compounding is when the earnings from an investment generate further earnings. The interest earned is added to the principal, and in the next period, you earn interest on this new, larger amount. This creates exponential growth.

▼

Starting early is very important. The earlier you start, the more time your money has to grow through compounding. Even small, consistent investments can turn into significant sums over the long term due to exponential growth.

▼

Recommended options that people consider are stocks, bonds, index funds, and ETFs. Each has different risk levels and potential returns, so diversifying your investments is crucial. High-yield savings accounts and CDs are also viable.

▼

Maximizing compounding involves reinvesting dividends, using dollar-cost averaging, and occasionally seeking help from financial advisors. Making smart and consistent investment decisions improves results over time.

▼

To turn $5,000 into $50,000 in 20 years, you would need an average annual return of about 12%. This can be achieved with a diversified portfolio, but it’s not guaranteed and involves a higher risk tolerance.

Conclusion

In conclusion, the power of turning investments with compounding highlights all the investment opportunities available for the future. By understanding all its benefits and getting started today, it can open more doors for wealth creation.