US Treasury Yields Surge: Expert Investment Strategies Revealed

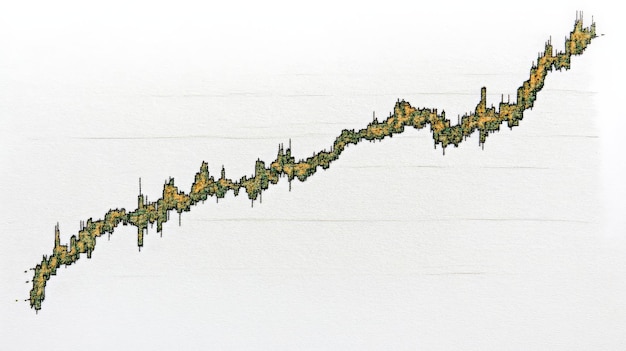

US Treasury yields have recently surged to 4.8%, prompting expert analysis and the formulation of new investment strategies to navigate potential market impacts and capitalize on emerging opportunities.

The recent surge in US Treasury yields to 4.8% has sent ripples through the financial markets, prompting investors and analysts to reassess their strategies. This article delves into the factors driving this increase, its potential impact on various asset classes, and the expert investment strategies that can help navigate this evolving landscape.

Understanding the US Treasury Yield Surge

The rise in US Treasury yields reflects several underlying factors that are shaping the current economic environment. Understanding these drivers is crucial for investors looking to anticipate future market movements and adjust their portfolios accordingly.

Economic Growth and Inflation

Stronger-than-expected economic growth and persistent inflation are primary contributors to the increase in Treasury yields. When the economy shows signs of robust expansion, investors anticipate higher inflation rates.

- Increased Consumer Spending: Higher consumer spending can drive inflation upwards, leading to expectations of tighter monetary policy.

- Supply Chain Normalization: As supply chains normalize, increased demand can outpace supply, causing prices to rise.

- Wage Growth: Rising wages, particularly in a tight labor market, can contribute to inflationary pressures.

These factors collectively push yields higher as investors demand greater compensation for the perceived risk of holding bonds in an inflationary environment.

The Ripple Effect on Financial Markets

The surge in Treasury yields has far-reaching implications for various sectors of the financial market. It affects everything from mortgage rates to corporate borrowing costs, influencing investment decisions across the board.

Impact on Equity Markets

Higher Treasury yields can put downward pressure on equity valuations, particularly for growth stocks. As yields rise, bonds become more attractive relative to stocks, leading to a shift in investor preferences.

Companies with high debt levels may face increased borrowing costs, impacting their profitability and growth prospects. This is especially relevant for sectors such as real estate and utilities, which are heavily reliant on debt financing.

- Sector Rotation: Investors may shift from growth stocks to value stocks as higher yields make the latter more appealing.

- Increased Volatility: The uncertainty surrounding the pace and magnitude of yield increases can lead to heightened market volatility.

- Earnings Impact: Companies may need to adjust their earnings forecasts to account for higher interest expenses.

Understanding these dynamics is essential for navigating the equity market during periods of rising Treasury yields.

Expert Insights on the Yield Curve

The shape of the yield curve provides valuable insights into the market’s expectations for future economic growth and inflation. Experts closely monitor the yield curve to assess potential risks and opportunities.

A flattening or inverting yield curve, where short-term yields are higher than long-term yields, is often seen as a predictor of an economic slowdown or recession. This occurs because investors anticipate that the Federal Reserve will lower interest rates in the future to stimulate the economy.

The Role of the Federal Reserve

The Federal Reserve’s monetary policy decisions play a crucial role in influencing Treasury yields. Changes in the federal funds rate and the Fed’s balance sheet can have a significant impact on the yield curve. Investors pay close attention to the Fed’s communications and actions to gauge the future direction of interest rates.

Quantitative easing (QE), where the Fed purchases Treasury bonds and other assets, can lower yields by increasing demand for these securities. Conversely, quantitative tightening (QT), where the Fed reduces its balance sheet, can push yields higher.

Investment Strategies for a Rising Yield Environment

Navigating a rising yield environment requires a strategic approach to investing. Experts recommend several strategies to mitigate risks and capitalize on opportunities.

Diversification

Diversifying your portfolio across different asset classes can help reduce the impact of rising yields. Consider allocating a portion of your investments to assets that are less sensitive to interest rate changes, such as commodities or international equities.

Real estate investment trusts (REITs) can offer diversification benefits, but it’s important to select REITs that are well-managed and have strong balance sheets. Certain sectors, such as healthcare and data centers, may be more resilient during economic downturns.

- Commodities: Investing in commodities can provide a hedge against inflation and currency fluctuations.

- International Equities: Allocating a portion of your portfolio to international equities can reduce your exposure to US-specific risks.

- Alternative Investments: Consider alternative investments such as private equity or hedge funds, which may offer different risk-return profiles.

Fixed Income Adjustments

In the fixed income space, consider shortening the duration of your bond portfolio to reduce its sensitivity to rising yields. This can be achieved by investing in shorter-term bonds or floating-rate notes.

Floating-rate notes offer yields that adjust periodically based on a benchmark interest rate, such as the London Interbank Offered Rate (LIBOR) or the Secured Overnight Financing Rate (SOFR). This can help protect your portfolio from interest rate risk.

Inflation-Protected Securities

Treasury Inflation-Protected Securities (TIPS) are designed to protect investors from inflation by adjusting their principal value based on changes in the Consumer Price Index (CPI). TIPS can be a valuable addition to a fixed income portfolio in an inflationary environment.

Consider investing in a TIPS exchange-traded fund (ETF) to gain diversified exposure to inflation-protected securities. These ETFs typically have low expense ratios and offer easy liquidity.

Sector-Specific Strategies

Certain sectors may perform better than others in a rising yield environment. Identifying and investing in these sectors can enhance your portfolio’s overall performance.

Financial Sector

The financial sector, particularly banks, can benefit from rising yields as they can charge higher interest rates on loans. Look for banks with strong capital ratios and a diversified loan portfolio.

Insurance companies can also benefit from rising yields as they reinvest premiums at higher rates. Consider investing in insurance companies with a strong track record of underwriting profitability.

- Diversified Loan Portfolio: Banks with a diversified loan portfolio are better positioned to weather economic downturns.

- Strong Capital Ratios: Financial institutions with strong capital ratios are more resilient to unexpected losses.

- Underwriting Profitability: Insurance companies with a strong track record of underwriting profitability are more likely to generate consistent returns.

Long-Term Perspective

While it’s important to adapt your investment strategy to changing market conditions, it’s equally important to maintain a long-term perspective. Avoid making impulsive decisions based on short-term market fluctuations.

Remember that market cycles are a normal part of investing. Focus on building a well-diversified portfolio that aligns with your long-term financial goals. Consider working with a financial advisor to develop a personalized investment plan.

| Key Point | Brief Description |

|---|---|

| 📈 Rising Yields | Driven by economic growth and inflation expectations. |

| 📊 Equity Impact | Can pressure equity valuations, especially for growth stocks. |

| 🛡️ Diversification | Essential for mitigating risks in a rising yield environment. |

| 🏦 Financial Sector | May benefit from higher interest rates on loans. |

Frequently Asked Questions

▼

US Treasury yields rise due to factors like economic growth, inflation expectations, and changes in monetary policy by the Federal Reserve. Stronger economic data often leads to higher yields.

▼

Rising Treasury yields can negatively impact the stock market by making bonds more attractive, which may lead to a shift in investor preference from stocks to bonds and increased market volatility.

▼

Suitable investment strategies during a yield surge include diversifying your portfolio, shortening bond duration, and considering TIPS. These strategies can help mitigate risks and capitalize on opportunities.

▼

The Federal Reserve plays a key role in managing Treasury yields through its monetary policy decisions, such as adjusting the federal funds rate and implementing quantitative easing or tightening measures.

▼

TIPS protect investors from inflation by adjusting their principal value based on changes in the Consumer Price Index (CPI). As inflation rises, the principal of TIPS increases, preserving real value.

Conclusion

The surge in US Treasury yields to 4.8% presents both challenges and opportunities for investors. By understanding the factors driving this increase and adopting appropriate investment strategies, it is possible to navigate the evolving financial landscape effectively and achieve your long-term financial goals.